Multiple Choice

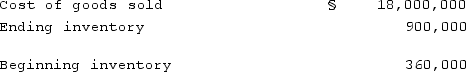

A U.S. company's foreign subsidiary had the following amounts in stickles (§) , the functional currency, in 2021:  The average exchange rate during 2021 was §1 = $0.98. The beginning inventory was acquired when the exchange rate was §1 = $1.18. The ending inventory was acquired when the exchange rate was §1 = $0.92. The exchange rate at December 31, 2021 was §1 = $0.82. At what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2021 U.S. dollar income statement?

The average exchange rate during 2021 was §1 = $0.98. The beginning inventory was acquired when the exchange rate was §1 = $1.18. The ending inventory was acquired when the exchange rate was §1 = $0.92. The exchange rate at December 31, 2021 was §1 = $0.82. At what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2021 U.S. dollar income statement?

A) $21,240,000.

B) $16,560,000.

C) $17,640,000.

D) $14,760,000.

E) $17,110,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q65: Esposito is an Italian subsidiary of a

Q66: Esposito is an Italian subsidiary of a

Q67: A foreign subsidiary uses the first-in first-out

Q68: Boerkian Co. started 2021 with two assets:

Q69: If a subsidiary is operating in a

Q71: Contrast the purpose of remeasurement with the

Q72: Ginvold Co. began operating a subsidiary in

Q73: Under what circumstances would the remeasurement of

Q74: Perez Company, a Mexican subsidiary of a

Q75: Dilty Corp. owned a subsidiary in France.