Essay

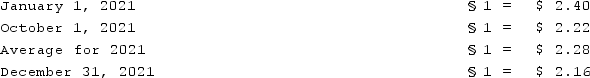

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2021 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2022. A building was then purchased for §170,000 on January 1, 2021. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2021. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:  Prepare a statement of cash flows for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Prepare a statement of cash flows for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Correct Answer:

Verified

Calcula...

Calcula...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: A foreign subsidiary uses the first-in first-out

Q68: Boerkian Co. started 2021 with two assets:

Q69: If a subsidiary is operating in a

Q70: A U.S. company's foreign subsidiary had the

Q71: Contrast the purpose of remeasurement with the

Q73: Under what circumstances would the remeasurement of

Q74: Perez Company, a Mexican subsidiary of a

Q75: Dilty Corp. owned a subsidiary in France.

Q76: Under the current rate method, depreciation expense

Q77: Certain balance sheet accounts of a foreign