Multiple Choice

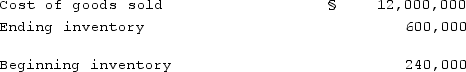

A U.S. company's foreign subsidiary had the following amounts in stickles (§) , the functional currency, in 2021:  The average exchange rate during 2021 was §1 = $0.96. The beginning inventory was acquired when the exchange rate was §1 = $1.20. The ending inventory was acquired when the exchange rate was §1 = $0.90. The exchange rate at December 31, 2021 was §1 = $0.84. Assuming that the foreign nation for the subsidiary had a highly inflationary economy, at what amount should that foreign subsidiary's purchases have been reflected in the 2021 U.S. dollar income statement?

The average exchange rate during 2021 was §1 = $0.96. The beginning inventory was acquired when the exchange rate was §1 = $1.20. The ending inventory was acquired when the exchange rate was §1 = $0.90. The exchange rate at December 31, 2021 was §1 = $0.84. Assuming that the foreign nation for the subsidiary had a highly inflationary economy, at what amount should that foreign subsidiary's purchases have been reflected in the 2021 U.S. dollar income statement?

A) $11,865,600.

B) $11,577,600.

C) $11,520,000.

D) $11,613,600.

E) $11,523,600.

Correct Answer:

Verified

Correct Answer:

Verified

Q56: Certain balance sheet accounts of a foreign

Q57: Kennedy Company acquired all of the outstanding

Q58: Boerkian Co. started 2021 with two assets:

Q59: Quadros Inc., a Portuguese firm was acquired

Q60: Under the current rate method, common stock

Q62: Perkle Co. owned a subsidiary in Belgium;

Q63: Boerkian Co. started 2021 with two assets:

Q64: A net liability balance sheet exposure exists

Q65: Esposito is an Italian subsidiary of a

Q66: Esposito is an Italian subsidiary of a