Essay

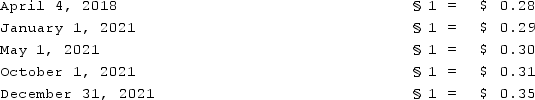

Boerkian Co. started 2021 with two assets: Cash of §26,000 (Stickles) and Land that originally cost §72,000 when acquired on April 4, 2018. On May 1, 2021, the company rendered services to a customer for §36,000, an amount immediately paid in cash. On October 1, 2021, the company incurred an operating expense of §22,000 that was immediately paid. No other transactions occurred during the year so an average exchange rate is not necessary. Currency exchange rates were as follows:  Assume Boerkian was a foreign subsidiary of a U.S. multinational company and the U.S. dollar was the functional currency of the subsidiary. Prepare a schedule of changes in the net monetary assets of Boerkian for the year 2021 and properly label the resulting gain or loss.

Assume Boerkian was a foreign subsidiary of a U.S. multinational company and the U.S. dollar was the functional currency of the subsidiary. Prepare a schedule of changes in the net monetary assets of Boerkian for the year 2021 and properly label the resulting gain or loss.

Correct Answer:

Verified

The remeasurement ga...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q53: Under the temporal method, depreciation expense would

Q54: Under the temporal method, common stock would

Q55: Quadros Inc., a Portuguese firm was acquired

Q56: Certain balance sheet accounts of a foreign

Q57: Kennedy Company acquired all of the outstanding

Q59: Quadros Inc., a Portuguese firm was acquired

Q60: Under the current rate method, common stock

Q61: A U.S. company's foreign subsidiary had the

Q62: Perkle Co. owned a subsidiary in Belgium;

Q63: Boerkian Co. started 2021 with two assets: