Multiple Choice

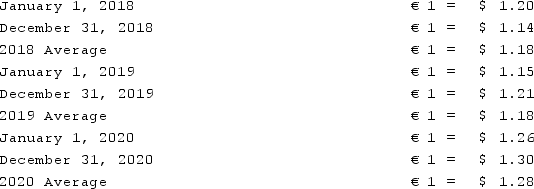

A subsidiary of Reynolds Inc., a U.S. company, was located in a foreign country. The local currency of this subsidiary was the Euro (€) while the functional currency of this subsidiary was the U.S. dollar. The subsidiary acquired Equipment A on January 1, 2018, for €250,000. Depreciation expense associated with Equipment A was €25,000 per year. On January 1, 2020, the subsidiary acquired Equipment B for €150,000 and Equipment B had associated depreciation expense of €10,000. The subsidiary owned no other depreciable assets. Currency exchange rates between the U.S. dollar and the Euro were as follows:  What amount would have been reported for depreciation expense related to the equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2018?

What amount would have been reported for depreciation expense related to the equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2018?

A) $29,500.

B) $28,500.

C) $30,000.

D) $12,000.

E) $11,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Under the current rate method, which accounts

Q45: A U.S. company's foreign subsidiary had the

Q46: What is the basic objective underlying the

Q47: A foreign subsidiary of a U.S. corporation

Q48: Perez Company, a Mexican subsidiary of a

Q50: Esposito is an Italian subsidiary of a

Q51: A subsidiary of Reynolds Inc., a U.S.

Q52: Which method of translating a foreign subsidiary's

Q53: Under the temporal method, depreciation expense would

Q54: Under the temporal method, common stock would