Multiple Choice

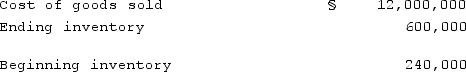

A U.S. company's foreign subsidiary had the following amounts in stickles (§) in 2021:  The average exchange rate during 2021 was §1 = $0.96. The beginning inventory was acquired when the exchange rate was §1 = $1.20. The ending inventory was acquired when the exchange rate was §1 = $0.90. The exchange rate at December 31, 2021 was §1 = $0.84. Assuming that the foreign country had a highly inflationary economy, at what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2021 U.S. dollar income statement?

The average exchange rate during 2021 was §1 = $0.96. The beginning inventory was acquired when the exchange rate was §1 = $1.20. The ending inventory was acquired when the exchange rate was §1 = $0.90. The exchange rate at December 31, 2021 was §1 = $0.84. Assuming that the foreign country had a highly inflationary economy, at what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2021 U.S. dollar income statement?

A) $11,253,600.

B) $11,577,600.

C) $11,649,600.

D) $11,613,600.

E) $11,523,600.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: When preparing a consolidation worksheet for a

Q41: A subsidiary of Dunder Inc., a U.S.

Q42: A net asset balance sheet exposure exists

Q43: Quadros Inc., a Portuguese firm was acquired

Q44: Under the current rate method, which accounts

Q46: What is the basic objective underlying the

Q47: A foreign subsidiary of a U.S. corporation

Q48: Perez Company, a Mexican subsidiary of a

Q49: A subsidiary of Reynolds Inc., a U.S.

Q50: Esposito is an Italian subsidiary of a