Multiple Choice

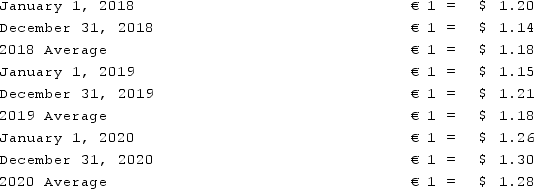

A subsidiary of Reynolds Inc., a U.S. company, was located in a foreign country. The local currency of this subsidiary was the Euro (€) while the functional currency of this subsidiary was the U.S. dollar. The subsidiary acquired Equipment A on January 1, 2018, for €250,000. Depreciation expense associated with Equipment A was €25,000 per year. On January 1, 2020, the subsidiary acquired Equipment B for €150,000 and Equipment B had associated depreciation expense of €10,000. The subsidiary owned no other depreciable assets. Currency exchange rates between the U.S. dollar and the Euro were as follows:  What amount would have been reported for total equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2018?

What amount would have been reported for total equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2018?

A) $285,000.

B) $456,000.

C) $295,000.

D) $300,000.

E) $472,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q91: Under the temporal method, property, plant &

Q92: Certain balance sheet accounts of a foreign

Q93: Under the temporal method, how would cost

Q94: What exchange rate should be used to

Q95: What is the justification for the remeasurement

Q96: Under the current rate method, inventory at

Q97: Farley Brothers, a U.S. company, had a

Q98: Under the current rate method, retained earnings

Q99: What is the basic assumption underlying the

Q100: Certain balance sheet accounts of a foreign