Essay

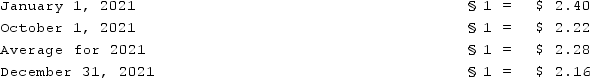

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2021 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2022. A building was then purchased for §170,000 on January 1, 2021. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2021. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:  Prepare a balance sheet for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Prepare a balance sheet for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Correct Answer:

Verified

Calcula...

Calcula...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: Gale Co. was formed on January 1,

Q33: How can a parent corporation determine the

Q34: Oscar, Ltd. is a British subsidiary of

Q35: Kennedy Company acquired all of the outstanding

Q36: Which method is used for remeasuring a

Q38: According to U.S. GAAP, when the local

Q39: When consolidating a foreign subsidiary, which of

Q40: When preparing a consolidation worksheet for a

Q41: A subsidiary of Dunder Inc., a U.S.

Q42: A net asset balance sheet exposure exists