Multiple Choice

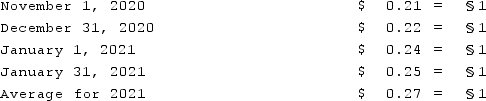

A subsidiary of Dunder Inc., a U.S. company, was located in a foreign country. The functional currency of this subsidiary was the Stickle (§) which is the local currency where the subsidiary is located. The subsidiary acquired inventory on credit on November 1, 2020, for §160,000 that was sold on January 17, 2021 for §207,000. The subsidiary paid for the inventory on January 31, 2021. Currency exchange rates between the dollar and the Stickle were as follows:  What amount would have been reported for this inventory in Dunder's consolidated balance sheet at December 31, 2020?

What amount would have been reported for this inventory in Dunder's consolidated balance sheet at December 31, 2020?

A) $35,200.

B) $33,600.

C) $38,400.

D) $40,000.

E) $43,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Which method is used for remeasuring a

Q37: Ginvold Co. began operating a subsidiary in

Q38: According to U.S. GAAP, when the local

Q39: When consolidating a foreign subsidiary, which of

Q40: When preparing a consolidation worksheet for a

Q42: A net asset balance sheet exposure exists

Q43: Quadros Inc., a Portuguese firm was acquired

Q44: Under the current rate method, which accounts

Q45: A U.S. company's foreign subsidiary had the

Q46: What is the basic objective underlying the