Multiple Choice

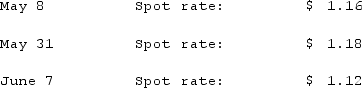

Clark Stone purchases raw material from its foreign supplier, Rinne Clay, on May 8. Payment of 1,500,000 foreign currency units (FC) is due in 30 days. May 31 is Clark's fiscal year-end. The pertinent exchange rates were as follows:  For what amount should Clark's Accounts Payable be credited on May 8?

For what amount should Clark's Accounts Payable be credited on May 8?

A) $1,740,000.

B) $1,850,000.

C) $1,500,000.

D) $1,680,000.

E) $1,770,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q77: To account for a forward contract cash

Q78: Curtis purchased inventory on December 1, 2020.

Q79: Jackson Corp. (a U.S.-based company) sold parts

Q80: What happens when a U.S. company sells

Q81: Which of the following statements is true

Q83: For each of the following situations, select

Q84: Coyote Corp. (a U.S. company in Texas)

Q85: All of the following data points are

Q86: How can an import purchase result in

Q87: Jackson Corp. (a U.S.-based company) sold parts