Multiple Choice

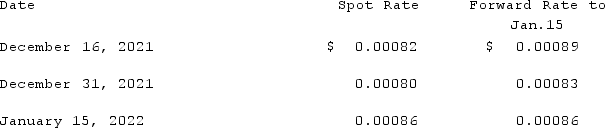

Jackson Corp. (a U.S.-based company) sold parts to a Korean customer on December 16, 2021, with payment of 20 million Korean won to be received on January 15, 2022. The following exchange rates applied:  Assuming a forward contract was entered into on December 16, what would be the net impact on Jackson's 2022 income statement related to this transaction?

Assuming a forward contract was entered into on December 16, what would be the net impact on Jackson's 2022 income statement related to this transaction?

A) $400 (gain) .

B) $400 (loss) .

C) $600 (gain) .

D) $600 (loss) .

E) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q74: Potter Corp. (a U.S. company in Colorado)

Q75: On October 1, 2021, Eagle Company forecasts

Q76: On October 1, 2021, Eagle Company forecasts

Q77: To account for a forward contract cash

Q78: Curtis purchased inventory on December 1, 2020.

Q80: What happens when a U.S. company sells

Q81: Which of the following statements is true

Q82: Clark Stone purchases raw material from its

Q83: For each of the following situations, select

Q84: Coyote Corp. (a U.S. company in Texas)