Multiple Choice

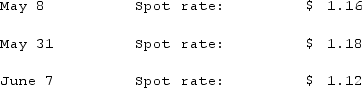

Clark Stone purchases raw material from its foreign supplier, Rinne Clay, on May 8. Payment of 1,500,000 foreign currency units (FC) is due in 30 days. May 31 is Clark's fiscal year-end. The pertinent exchange rates were as follows:  How much US $ will it cost Clark to finally pay the payable on June 7?

How much US $ will it cost Clark to finally pay the payable on June 7?

A) $1,850,000.

B) $1,500,000.

C) $1,770,000.

D) $1,740,000.

E) $1,680,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q66: Which statement is true regarding a foreign

Q67: Clark Co., a U.S. corporation, sold inventory

Q68: Potter Corp. (a U.S. company in Colorado)

Q69: On May 1, 2021, Mosby Company received

Q70: What is meant by the terms direct

Q72: What factors create a foreign exchange gain?

Q73: Schrute Inc. had a receivable from a

Q74: Potter Corp. (a U.S. company in Colorado)

Q75: On October 1, 2021, Eagle Company forecasts

Q76: On October 1, 2021, Eagle Company forecasts