Multiple Choice

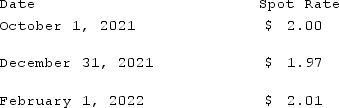

On October 1, 2021, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2022, at a price of 100,000 British pounds. On October 1, 2021, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2021, the option has a fair value of $1,600. The following spot exchange rates apply:  What is the amount of Adjustment to Accumulated Other Comprehensive Income for 2022 from these transactions?

What is the amount of Adjustment to Accumulated Other Comprehensive Income for 2022 from these transactions?

A) $1,000.

B) $1,600.

C) $1,800.

D) $2,000.

E) $2,600.

Correct Answer:

Verified

Correct Answer:

Verified

Q71: Clark Stone purchases raw material from its

Q72: What factors create a foreign exchange gain?

Q73: Schrute Inc. had a receivable from a

Q74: Potter Corp. (a U.S. company in Colorado)

Q75: On October 1, 2021, Eagle Company forecasts

Q77: To account for a forward contract cash

Q78: Curtis purchased inventory on December 1, 2020.

Q79: Jackson Corp. (a U.S.-based company) sold parts

Q80: What happens when a U.S. company sells

Q81: Which of the following statements is true