Multiple Choice

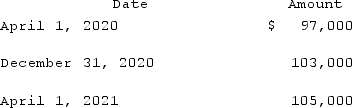

On April 1, 2020, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2021. The dollar value of the loan was as follows:  How much foreign exchange gain or loss should be included in Shannon's 2020 income statement?

How much foreign exchange gain or loss should be included in Shannon's 2020 income statement?

A) $3,000 gain.

B) $3,000 loss.

C) $6,000 gain.

D) $6,000 loss.

E) $7,000 gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q93: On June 1, Cagle Co. received a

Q94: Gaw Produce Company purchased inventory from a

Q95: Primo Inc., a U.S. company, ordered parts

Q96: On October 1, 2021, Eagle Company forecasts

Q97: On October 1, 2021, Jarvis Co. sold

Q99: Potter Corp. (a U.S. company in Colorado)

Q100: A U.S. company buys merchandise from a

Q101: Coyote Corp. (a U.S. company in Texas)

Q102: Which of the following is not a

Q103: What happens when a U.S. company sells