Multiple Choice

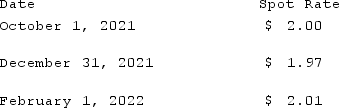

On October 1, 2021, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2022, at a price of 100,000 British pounds. On October 1, 2021, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2021, the option has a fair value of $1,600. The following spot exchange rates apply:  What is the amount of Cost of Goods Sold for 2022 as a result of these transactions?

What is the amount of Cost of Goods Sold for 2022 as a result of these transactions?

A) $200,000.

B) $195,000.

C) $201,000.

D) $202,600.

E) $203,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q91: Winston Corp., a U.S. company, had the

Q92: On December 1, 2021, Keenan Company, a

Q93: On June 1, Cagle Co. received a

Q94: Gaw Produce Company purchased inventory from a

Q95: Primo Inc., a U.S. company, ordered parts

Q97: On October 1, 2021, Jarvis Co. sold

Q98: On April 1, 2020, Shannon Company, a

Q99: Potter Corp. (a U.S. company in Colorado)

Q100: A U.S. company buys merchandise from a

Q101: Coyote Corp. (a U.S. company in Texas)