Multiple Choice

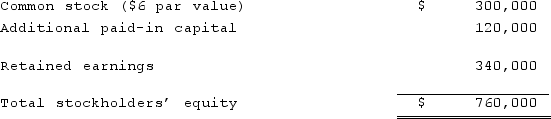

On January 1, 2021, Rhodes Co. owned 75% of the common stock of Brock Co. On that date, Brock's stockholders' equity accounts had the following balances:  The balance in Rhodes's Investment in Brock Co. account was $570,000, and the noncontrolling interest was $190,000. On January 1, 2021, Brock Co. sold 10,000 shares of previously unissued common stock for $12 per share. Rhodes did not acquire any of these shares.What amount should be attributed to the Noncontrolling Interest in Brock Co. following the sale of the 10,000 shares of common stock?

The balance in Rhodes's Investment in Brock Co. account was $570,000, and the noncontrolling interest was $190,000. On January 1, 2021, Brock Co. sold 10,000 shares of previously unissued common stock for $12 per share. Rhodes did not acquire any of these shares.What amount should be attributed to the Noncontrolling Interest in Brock Co. following the sale of the 10,000 shares of common stock?

A) $190,000.

B) $220,000.

C) $310,000.

D) $330,000.

E) $550,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Ryan Company purchased 80% of Chase Company

Q12: Duncan Inc. owned all of the outstanding

Q13: Johnson, Inc. owns control over Kaspar, Inc.

Q14: Panton, Inc. acquired 18,000 shares of Glotfelty

Q15: Panton, Inc. acquired 18,000 shares of Glotfelty

Q17: Key Company has had bonds payable of

Q18: The following information has been taken from

Q19: Where do intra-entity transfers of inventory appear

Q20: On January 1, 2021, Parent Corporation acquired

Q21: Ryan Company purchased 80% of Chase Company