Essay

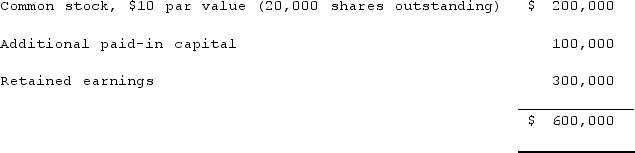

Panton, Inc. acquired 18,000 shares of Glotfelty Corp. several years ago for $30 per share when Glotfelty had a book value of $450,000. Before and after that time, Glotfelty's stock traded at $30 per share. At the present time, Glotfelty reports the following stockholders' equity:  Glotfelty issues 5,000 shares of previously unissued stock to the public for $40 per share. None of this stock is purchased by Panton.Describe how this transaction would affect Panton's books.

Glotfelty issues 5,000 shares of previously unissued stock to the public for $40 per share. None of this stock is purchased by Panton.Describe how this transaction would affect Panton's books.

Correct Answer:

Verified

The investment accou...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: A parent acquires all of a subsidiary's

Q11: Ryan Company purchased 80% of Chase Company

Q12: Duncan Inc. owned all of the outstanding

Q13: Johnson, Inc. owns control over Kaspar, Inc.

Q14: Panton, Inc. acquired 18,000 shares of Glotfelty

Q16: On January 1, 2021, Rhodes Co. owned

Q17: Key Company has had bonds payable of

Q18: The following information has been taken from

Q19: Where do intra-entity transfers of inventory appear

Q20: On January 1, 2021, Parent Corporation acquired