Multiple Choice

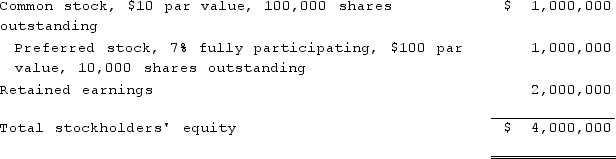

On January 1, 2021, Harrison Corporation spent $2,600,000 to acquire control over Involved, Inc. This price was based on paying $750,000 for 30% of Involved's preferred stock, and $1,850,000 for 80% of its outstanding common stock. As of the date of the acquisition, Involved's stockholders' equity accounts were as follows:  What is the total acquisition-date fair value of Involved?

What is the total acquisition-date fair value of Involved?

A) $2,600,000

B) $4,812,500

C) $3,062,500

D) $2,312,500

E) $3,250,000

Correct Answer:

Verified

Correct Answer:

Verified

Q88: The following information has been taken from

Q89: Skipen Corp. had the following stockholders' equity

Q90: Jacoby Co. owned a controlling interest in

Q91: Which of the following is not a

Q92: Parent Corporation acquired some of its subsidiary's

Q94: A parent acquires 70% of a subsidiary's

Q95: A company had common stock with a

Q96: Waite, Inc. owns 85% of Knight Corp.

Q97: On January 1, 2021, Harrison Corporation spent

Q98: How are intra-entity inventory transfers treated on