Multiple Choice

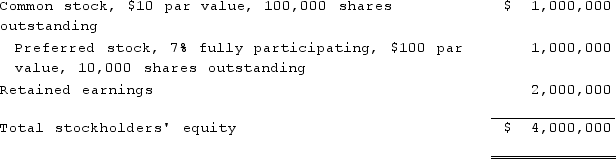

On January 1, 2021, Harrison Corporation spent $2,600,000 to acquire control over Involved, Inc. This price was based on paying $750,000 for 30% of Involved's preferred stock, and $1,850,000 for 80% of its outstanding common stock. As of the date of the acquisition, Involved's stockholders' equity accounts were as follows:  Assuming Involved's accounts are correctly valued within the company's financial statements, what amount of goodwill should be recognized for the Investment in Involved?

Assuming Involved's accounts are correctly valued within the company's financial statements, what amount of goodwill should be recognized for the Investment in Involved?

A) $(100,000.)

B) $0.

C) $200,000.

D) $812,500.

E) $2,112,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q92: Parent Corporation acquired some of its subsidiary's

Q93: On January 1, 2021, Harrison Corporation spent

Q94: A parent acquires 70% of a subsidiary's

Q95: A company had common stock with a

Q96: Waite, Inc. owns 85% of Knight Corp.

Q98: How are intra-entity inventory transfers treated on

Q99: A subsidiary issues new shares of common

Q100: A parent company owns a 70% interest

Q101: How would consolidated earnings per share be

Q102: Ryan Company purchased 80% of Chase Company