Multiple Choice

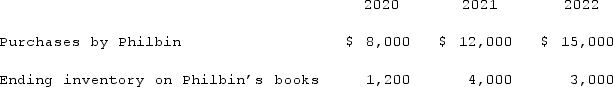

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

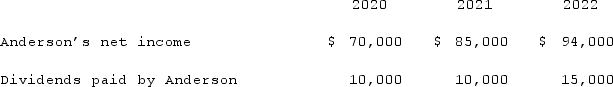

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.  Compute the equity in earnings of Anderson reported on Philbin's books for 2021.

Compute the equity in earnings of Anderson reported on Philbin's books for 2021.

A) $76,500.

B) $77,130.

C) $75,870.

D) $75,600.

E) $75,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q113: Will Co. owned 80% of the voting

Q114: Palmer Corp. owned 80% of the outstanding

Q115: An intra-entity transfer took place whereby the

Q116: On January 1, 2021, Pride, Inc. acquired

Q117: Patti Company owns 80% of the common

Q119: On January 1, 2020, Smeder Company, an

Q120: On January 1, 2021, Pride, Inc. acquired

Q121: Several years ago, Polar Inc. acquired an

Q122: Walsh Company sells inventory to its subsidiary,

Q123: Kenzie Co. acquired 70% of McCready Co.