Multiple Choice

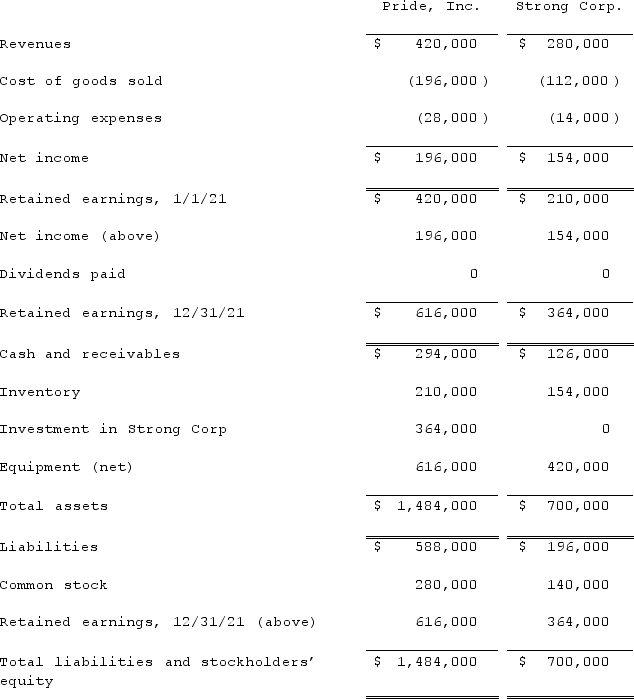

On January 1, 2021, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill, which has not been impaired.As of December 31, 2021, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the total of consolidated cost of goods sold at December 31, 2021?

During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the total of consolidated cost of goods sold at December 31, 2021?

A) $196,000.

B) $212,800.

C) $184,800.

D) $203,000.

E) $168,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q111: Anderson Company, a 90% owned subsidiary of

Q112: Patti Company owns 80% of the common

Q113: Will Co. owned 80% of the voting

Q114: Palmer Corp. owned 80% of the outstanding

Q115: An intra-entity transfer took place whereby the

Q117: Patti Company owns 80% of the common

Q118: Anderson Company, a 90% owned subsidiary of

Q119: On January 1, 2020, Smeder Company, an

Q120: On January 1, 2021, Pride, Inc. acquired

Q121: Several years ago, Polar Inc. acquired an