Multiple Choice

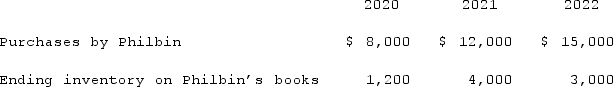

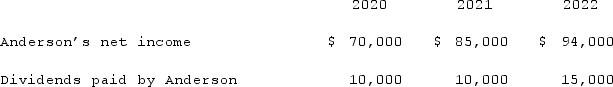

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.  For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2022 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2021 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2022 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2021 intra-entity transfer of merchandise?

A) $3,000.

B) $2,400.

C) $1,000.

D) $800.

E) $900.

Correct Answer:

Verified

Correct Answer:

Verified

Q106: On January 1, 2021, Daniel Corp. acquired

Q107: How does a gain on an intra-entity

Q108: On January 1, 2021, Pride, Inc. acquired

Q109: Which of the following statements is true

Q110: Colbert Inc. acquired 100% of Stewart Manufacturing

Q112: Patti Company owns 80% of the common

Q113: Will Co. owned 80% of the voting

Q114: Palmer Corp. owned 80% of the outstanding

Q115: An intra-entity transfer took place whereby the

Q116: On January 1, 2021, Pride, Inc. acquired