Multiple Choice

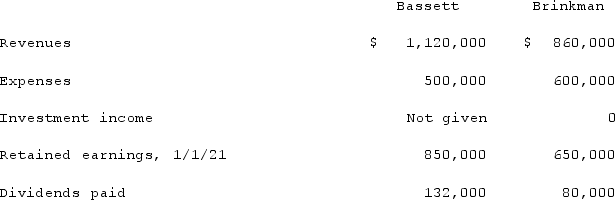

Bassett Inc. acquired all of the outstanding common stock of Brinkman Corp. on January 1, 2019, for $422,000. Equipment with a ten-year life was undervalued on Brinkman's financial records by $48,000. Brinkman also owned an unrecorded customer list with an assessed fair value of $71,000 and an estimated remaining life of five years.Brinkman earned reported net income of $185,000 in 2019 and $226,000 in 2020. Dividends of $75,000 were paid in each of these two years. Selected account balances as of December 31, 2021, for the two companies follow.  If the partial equity method had been applied, what was 2021 consolidated net income?

If the partial equity method had been applied, what was 2021 consolidated net income?

A) $260,000.

B) $620,000.

C) $861,000.

D) $880,000.

E) $1,291,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Utah Inc. acquired all of the outstanding

Q28: Jaynes Inc. acquired all of Aaron Co.'s

Q29: On 1/1/19, Sey Mold Corporation acquired 100%

Q30: Kaye Company acquired 100% of Fiore Company

Q31: Watkins, Inc. acquires all of the outstanding

Q33: When is a goodwill impairment loss recognized?<br>A)

Q34: One company acquires another company in a

Q35: For an acquisition when the subsidiary retains

Q36: Hoyt Corporation agreed to the following terms

Q37: Jackson Company acquires 100% of the stock