Multiple Choice

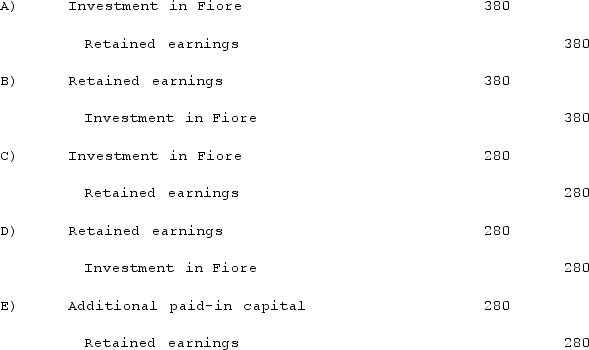

Kaye Company acquired 100% of Fiore Company on January 1, 2021. Kaye paid $1,000 excess consideration over book value, which is being amortized at $20 per year. There was no goodwill in the combination. Fiore reported net income of $400 in 2021 and paid dividends of $100.Assume the initial value method is used. In the year subsequent to acquisition, what additional worksheet entry must be made for consolidation purposes that is not required for the equity method?

A) Entry A.

B) Entry B.

C) Entry C.

D) Entry D.

E) Entry E.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Jackson Company acquires 100% of the stock

Q26: How is the fair value allocation of

Q27: Utah Inc. acquired all of the outstanding

Q28: Jaynes Inc. acquired all of Aaron Co.'s

Q29: On 1/1/19, Sey Mold Corporation acquired 100%

Q31: Watkins, Inc. acquires all of the outstanding

Q32: Bassett Inc. acquired all of the outstanding

Q33: When is a goodwill impairment loss recognized?<br>A)

Q34: One company acquires another company in a

Q35: For an acquisition when the subsidiary retains