Multiple Choice

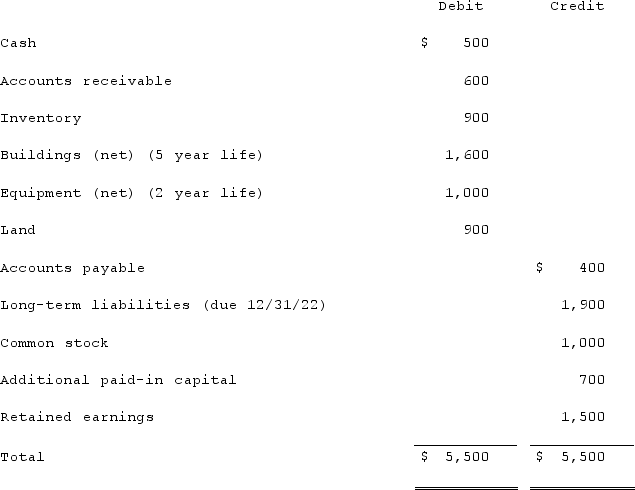

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

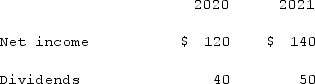

Net income and dividends reported by Clark for 2020 and 2021 follow:  The fair value of Clark's net assets that differ from their book values are listed below:

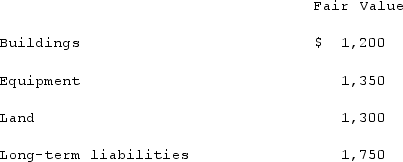

The fair value of Clark's net assets that differ from their book values are listed below:  Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute goodwill, if any, at January 1, 2020.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute goodwill, if any, at January 1, 2020.

A) $0.

B) $100.

C) $400.

D) $900.

E) $1,300.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Jackson Company acquires 100% of the stock

Q38: Jaynes Inc. acquired all of Aaron Co.'s

Q39: One company acquires another company in a

Q40: Beatty, Inc. acquires 100% of the voting

Q41: On 1/1/19, Sey Mold Corporation acquired 100%

Q43: Following are selected accounts for Green Corporation

Q44: Vaughn Inc. acquired all of the outstanding

Q45: What is the basic objective of all

Q46: Which one of the following accounts would

Q47: Yules Co. acquired Noel Co. and applied