Multiple Choice

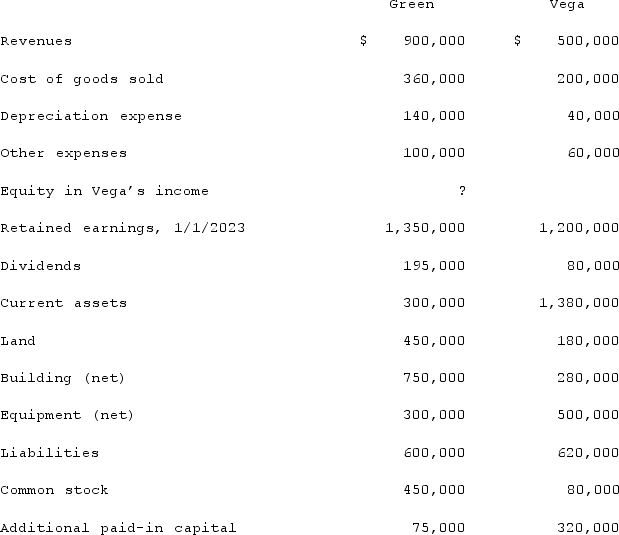

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated land.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated land.

A) $220,000.

B) $180,000.

C) $670,000.

D) $630,000.

E) $450,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Jaynes Inc. acquired all of Aaron Co.'s

Q39: One company acquires another company in a

Q40: Beatty, Inc. acquires 100% of the voting

Q41: On 1/1/19, Sey Mold Corporation acquired 100%

Q42: Jackson Company acquires 100% of the stock

Q44: Vaughn Inc. acquired all of the outstanding

Q45: What is the basic objective of all

Q46: Which one of the following accounts would

Q47: Yules Co. acquired Noel Co. and applied

Q48: Under the partial equity method of accounting