Multiple Choice

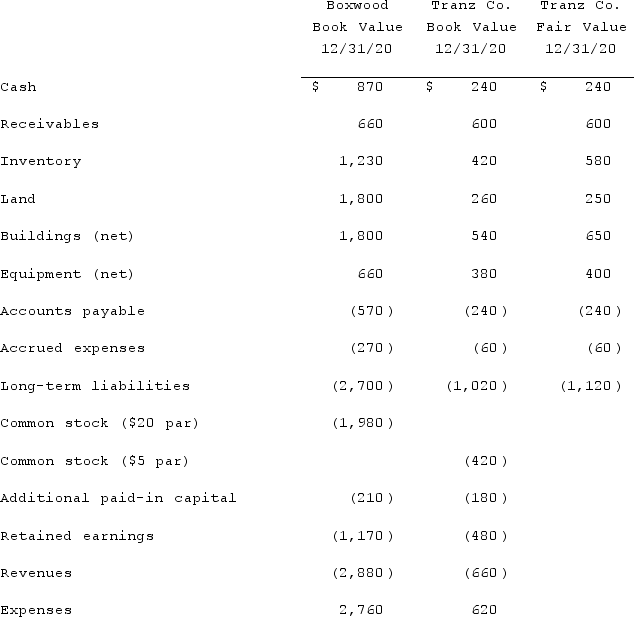

Presented below are the financial balances for the Boxwood Company and the Tranz Company as of December 31, 2020, immediately before Boxwood acquired Tranz. Also included are the fair values for Tranz Company's net assets at that date (all amounts in thousands) .  Note: Parenthesis indicate a credit balanceAssume a business combination took place at December 31, 2020. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .Compute consolidated buildings (net) immediately following the acquisition.

Note: Parenthesis indicate a credit balanceAssume a business combination took place at December 31, 2020. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .Compute consolidated buildings (net) immediately following the acquisition.

A) $2,450.

B) $2,340.

C) $1,800.

D) $650.

E) $1,690.

Correct Answer:

Verified

Correct Answer:

Verified

Q85: On January 1, 2021, the Moody Company

Q86: On January 1, 2021, the Moody Company

Q87: Jernigan Corp. had the following account balances

Q88: Prior to being united in a business

Q89: What is the difference in consolidated results

Q91: The financial statements for Campbell, Inc., and

Q92: The financial statement amounts for the Atwood

Q93: Flynn acquires 100 percent of the outstanding

Q94: The financial statements for Campbell, Inc., and

Q95: Describe the accounting for direct costs, indirect