Essay

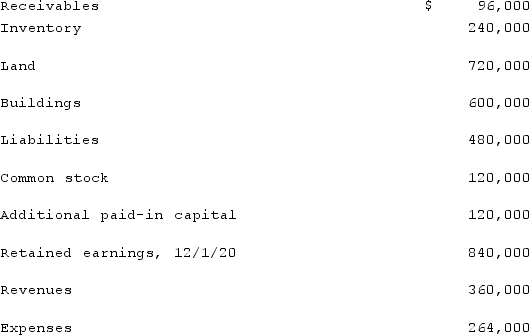

Jernigan Corp. had the following account balances at 12/1/20:  Several of Jernigan's accounts have fair values that differ from book value. The fair values are: Land - $480,000; Building - $720,000; Inventory - $336,000; and Liabilities - $396,000. Inglewood Inc. acquired all of the outstanding common shares of Jernigan by issuing 20,000 shares of common stock having a $6 par value per share, but a $66 fair value per share. Stock issuance costs amounted to $12,000.Required:Prepare a fair value allocation and goodwill schedule at the date of the acquisition.

Several of Jernigan's accounts have fair values that differ from book value. The fair values are: Land - $480,000; Building - $720,000; Inventory - $336,000; and Liabilities - $396,000. Inglewood Inc. acquired all of the outstanding common shares of Jernigan by issuing 20,000 shares of common stock having a $6 par value per share, but a $66 fair value per share. Stock issuance costs amounted to $12,000.Required:Prepare a fair value allocation and goodwill schedule at the date of the acquisition.

Correct Answer:

Verified

Correct Answer:

Verified

Q82: On January 1, 2021, the Moody Company

Q83: The financial statement amounts for the Atwood

Q84: How are stock issuance costs accounted for

Q85: On January 1, 2021, the Moody Company

Q86: On January 1, 2021, the Moody Company

Q88: Prior to being united in a business

Q89: What is the difference in consolidated results

Q90: Presented below are the financial balances for

Q91: The financial statements for Campbell, Inc., and

Q92: The financial statement amounts for the Atwood