Multiple Choice

Figure 4-21

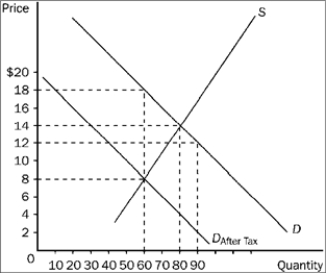

-Refer to Figure 4-21. The per-unit burden of the tax is

A) $4 on buyers and $4 on sellers.

B) $5 on buyers and $5 on sellers.

C) $4 on buyers and $6 on sellers.

D) $6 on buyers and $4 on sellers.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: A black market is<br>A) a market that

Q19: Price controls will tend to cause misallocation

Q20: Figure 4-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-22

Q21: The "incidence of a tax" is the

Q22: Which of the following statements regarding black

Q24: Other things constant, how will a decrease

Q25: Economic analysis indicates minimum wage legislation has<br>A)

Q26: Use the figure below to answer the

Q27: If the government wants to generate large

Q28: Use the figure below illustrating the impact