Multiple Choice

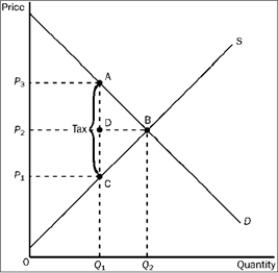

Figure 4-24

-Refer to Figure 4-24. The per-unit burden of the tax on sellers is

A) P3 − P1.

B) P3 − P2.

C) P2 − P1.

D) Q2 − Q1.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q236: A legal system that provides secure private

Q237: Use the figure below to answer the

Q238: Which tax rate measures the percent of

Q239: A subsidy on a product will generate

Q240: The more elastic the supply of a

Q242: Which of the following about minimum wage

Q243: Figure 4-18 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-18

Q244: Figure 4-25 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-25

Q245: The market pricing system corrects an excess

Q246: Use the table below to choose the