Multiple Choice

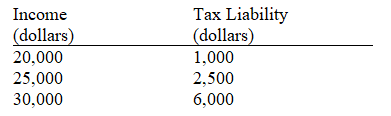

Use the table below to choose the correct answer.

The marginal tax rate on income in the $25,000 to $30,000 range is

A) 10 percent.

B) 20 percent.

C) 50 percent.

D) 70 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q241: Figure 4-24 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-24

Q242: Which of the following about minimum wage

Q243: Figure 4-18 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-18

Q244: Figure 4-25 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-25

Q245: The market pricing system corrects an excess

Q247: A proportional tax is defined as a

Q248: A substantial revision of the income tax

Q249: Suppose that the federal government grants a

Q250: If a government price control succeeds in

Q251: Figure 4-25 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-25