Multiple Choice

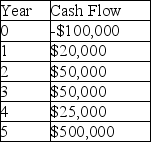

A project manager is using the payback method to make the final decision on which project to undertake. The company has a 10% required rate of return and expects a 4% rate of inflation for the following five years. What is the discounted payback of a project that has cash flows as shown in the table?

A) 3.4 years

B) 2.6 years

C) 5.0 years

D) 4.2 years

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Internal rate of return is preferable to

Q11: Inatech is contemplating two different projects and

Q17: Realignment describes:<br>A)The change in a project portfolio

Q29: Evaluating projects in terms of their strategic

Q49: Which of these statements about internal rate

Q54: Between projects A and B,project A will

Q65: A simplified scoring model is used to

Q68: Souder's project screening criterion that indicates an

Q77: How can a payback period approach be

Q98: A proactive project portfolio:<br>A)Is as simple as