Essay

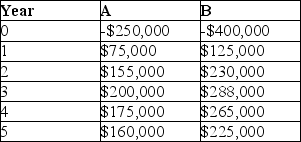

Inatech is contemplating two different projects and decides to perform a financial analysis to determine which is more financially lucrative. Project A and B have the cash flows as shown and Inatech uses a required rate of return of 10% and an inflation rate of 4%. Compute the payback in years and the net present value for both projects and offer advice as to the best course of action.

Correct Answer:

Verified

The NPV for project A is $256,764 and t...

The NPV for project A is $256,764 and t...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Rank the problems in implementing portfolio management

Q18: The Analytical Hierarchy Process elegantly addresses scaling

Q41: A company facing an interest rate of

Q47: The concept of project portfolio management holds

Q51: A commercial factor in project selection and

Q58: If strategy and portfolio are not in

Q82: Souder's model selection criterion that encourages ease

Q88: A project manager is using the net

Q97: Which of these statements about valuation models

Q101: How does the Analytical Hierarchy Process differ