Essay

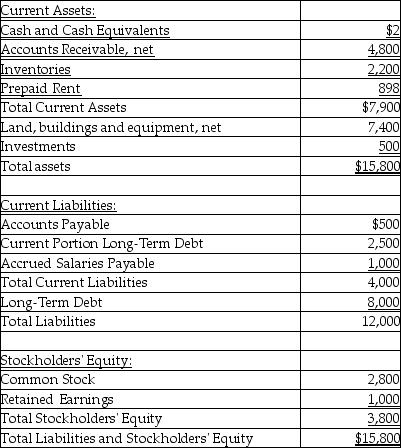

The balance sheet at December 31, 2017 for Zumba Company follows:

in thousands of dollars, unless otherwise specified

Additional information follows:

Additional information follows:

1. Net income for the year ended December 31, 2017 is $2,020.

2. Cost of goods sold for the year ended December 31, 2017 is $4,400.

3. Inventory on January 1, 2017 is $1,800.

4. Accounts Receivable, net on January 1, 2017 are $4,400.

5. Total assets on January 1, 2017 are $20,000.

6. Net credit sales for the year ended December 31, 2017 are $14,600.

7. Net income before interest and taxes for the year ended December 31, 2017 is $4,800.

8. Interest expense for the year ended December 31, 2017 is $550.

9. Total stockholders' equity on January 1, 2017 is $3,500.

Compute the following ratios:

1. Current ratio

2. Quick ratio

3. Accounts receivable turnover

4. Days' inventory outstanding

5. Times interest earned

6. Return on assets

7. Return on equity

Correct Answer:

Verified

1. Current ratio = $7,900 ÷ $4,000 = 1.9...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: The percentage change in any individual item

Q29: Common-size financial statements report only dollar amounts.

Q69: Which of the following is typically used

Q73: Red flags in financial statement analysis can

Q75: Szidon Company reports the following data: <img

Q76: Zebra Company reports the following figures for

Q77: You are the CEO of Company A

Q79: Mussa Corporation reports the following data: <img

Q83: Horizontal analysis is performed on information from:<br>A)only

Q98: Vertical analysis compares a line item on