Multiple Choice

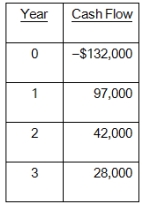

Soft and Cuddly is considering a new toy that will produce the following cash flows.Should the company produce this toy based on IRR if the firm requires a rate of return of 17.5 percent?

A) Yes, because the project's rate of return is 16.45 percent

B) Yes, because the project's rate of return is 11.47 percent

C) No, because the project's rate of return is 16.45 percent

D) No, because the project's rate of return is 11.47 percent

E) No, because the internal rate of return is zero percent

Correct Answer:

Verified

Correct Answer:

Verified

Q2: You were recently hired by a firm

Q3: If a project with conventional cash flows

Q4: What is the IRR of the following

Q5: Both Projects A and B are acceptable

Q6: Murphy's Authentic is considering a project with

Q7: You are considering the following two mutually

Q8: Based on the most recent survey information

Q9: Which one of the following methods of

Q10: The net present value:<br>A)decreases as the required

Q11: Which one of the following methods of