Multiple Choice

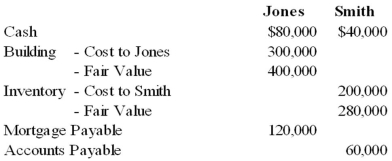

Jones and Smith formed a partnership with each partner contributing the following items:  Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

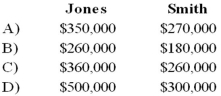

Refer to the above information. What is each partner's tax basis in the Jones and Smith partnership?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q7: In the ABC partnership (to which Daniel

Q8: When a partner retires from a partnership

Q10: In the AD partnership, Allen's capital is

Q13: In the JAW partnership,Jane's capital is $100,000,Anne's

Q17: In the AD partnership, Allen's capital is

Q18: A joint venture may be organized as

Q23: Which of the following accounts is not

Q34: Which of the following accounts could be

Q36: Griffin and Rhodes formed a partnership on

Q42: When a partnership is formed,noncash assets contributed