Multiple Choice

In the AD partnership, Allen's capital is $140,000 and Daniel's is $40,000 and they share income in a 3:1 ratio, respectively. They decide to admit David to the partnership. Each of the following question is independent of the others.

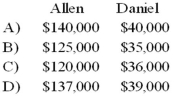

Refer to the information provided above. Allen and Daniel agree that some of the inventory is obsolete. The inventory account is decreased before David is admitted. David invests $40,000 for a one-fifth interest. What are the capital balances of Allen and Daniel after David is admitted into the partnership?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q8: When a partner retires from a partnership

Q12: Jones and Smith formed a partnership with

Q13: In the JAW partnership,Jane's capital is $100,000,Anne's

Q18: In the AD partnership, Allen's capital is

Q20: RD formed a partnership on February 10,

Q21: The DEF partnership reported net income of

Q23: Which of the following accounts is not

Q34: Which of the following accounts could be

Q35: Shue,a partner in the Financial Brokers Partnership,has

Q41: Paul and Ray sell musical instruments through