Multiple Choice

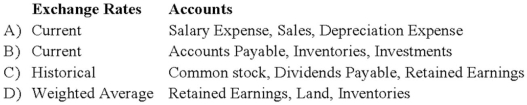

Which combination of accounts and exchange rates is correct for the translation of a foreign entity's financial statements from the functional currency to U.S. dollars?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q23: Which of the following defines a foreign-based

Q26: Briefly explain the following terms associated with

Q45: On January 2, 20X8, Johnson Company acquired

Q46: Infinity Corporation acquired 80 percent of the

Q48: Mercury Company is a subsidiary of Neptune

Q49: Dover Company owns 90% of the capital

Q50: When the local currency of the foreign

Q52: On January 2, 20X8, Johnson Company acquired

Q53: On January 1, 2008, Pace Company acquired

Q55: Note: This is a Kaplan CPA Review