Multiple Choice

Note: This is a Kaplan CPA Review Question

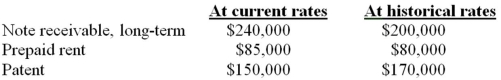

Certain balance sheet accounts of a foreign subsidiary of Rowan, Inc. (Rowan) at December 31, 20X6, have been translated into U.S. dollars as follows:

The subsidiary's functional currency is the currency of the country in which it is located.

What total amount should be included in Rowan's December 31, 20X6 consolidated balance sheet for the above accounts?

A) $450,000

B) $475,000

C) $455,000

D) $495,000

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Nichols Company owns 90% of the capital

Q23: Which of the following defines a foreign-based

Q26: Briefly explain the following terms associated with

Q50: Which combination of accounts and exchange rates

Q52: On January 2, 20X8, Johnson Company acquired

Q53: On January 1, 2008, Pace Company acquired

Q56: All of the following stockholders' equity accounts

Q57: Mercury Company is a subsidiary of Neptune

Q58: On January 2, 20X8, Johnson Company acquired

Q59: On January 2, 20X8, Johnson Company acquired