Multiple Choice

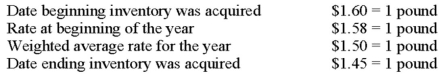

The British subsidiary of a U.S. company reported cost of goods sold of 75,000 pounds (sterling) for the current year ended December 31. The beginning inventory was 10,000 pounds, and the ending inventory was 15,000 pounds. Spot rates for various dates are as follows:  Assuming the pound is the functional currency of the British subsidiary, the translated amount of cost of goods sold that should appear in the consolidated income statement is:

Assuming the pound is the functional currency of the British subsidiary, the translated amount of cost of goods sold that should appear in the consolidated income statement is:

A) $108,750.

B) $112,500.

C) $114,300.

D) $125,700.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: On January 1, 20X8, Transport Corporation acquired

Q16: Prepare a schedule providing a proof of

Q17: Seattle, Inc. owns an 80 percent interest

Q17: Which of the following statements is true

Q18: Michigan-based Leo Corporation acquired 100 percent of

Q20: Michigan-based Leo Corporation acquired 100 percent of

Q21: On January 2, 20X8, Johnson Company acquired

Q22: On January 1, 2008, Pace Company acquired

Q45: The gain or loss on the effective

Q52: When the local currency of the foreign