Multiple Choice

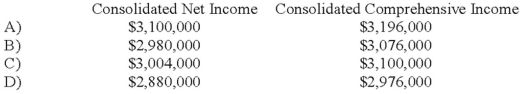

Seattle, Inc. owns an 80 percent interest in a Portuguese subsidiary. For 20X8, Seattle reported income from operations of $2.0 million. The Portuguese company's income from operations, after foreign currency translation, was $1.1 million. The foreign currency translation adjustment was $120,000 (credit) . Consolidated net income and consolidated comprehensive income for the year are:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Note: This is a Kaplan CPA Review

Q13: Michigan-based Leo Corporation acquired 100 percent of

Q14: On January 1, 20X8, Transport Corporation acquired

Q16: Prepare a schedule providing a proof of

Q17: Which of the following statements is true

Q18: Michigan-based Leo Corporation acquired 100 percent of

Q19: The British subsidiary of a U.S. company

Q20: Michigan-based Leo Corporation acquired 100 percent of

Q21: On January 2, 20X8, Johnson Company acquired

Q22: On January 1, 2008, Pace Company acquired