Multiple Choice

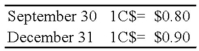

On September 30, 20X8, Wilfred Company sold inventory to Jackson Corporation, its Canadian subsidiary. The goods cost Wilfred $30,000 and were sold to Jackson for $40,000, payable in Canadian dollars. The goods are still on hand at the end of the year on December 31. The Canadian dollar (C$) is the functional currency of the Canadian subsidiary. The exchange rates follow:  Based on the preceding information, what amount of unrealized intercompany gross profit is eliminated in preparing the consolidated financial statements for the year?

Based on the preceding information, what amount of unrealized intercompany gross profit is eliminated in preparing the consolidated financial statements for the year?

A) $0

B) $5,000

C) $10,000

D) $15,000

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Under the temporal method,which of the following

Q29: On September 30, 20X8, Wilfred Company sold

Q30: If the functional currency is the local

Q35: If the functional currency is the local

Q36: Note: This is a Kaplan CPA Review

Q37: The British subsidiary of a U.S. company

Q38: The balance in Newsprint Corp.'s foreign exchange

Q39: Elan, a U.S. corporation, completed the December

Q48: Dividends of a foreign subsidiary are translated

Q54: Parisian Co.is a French company located in