Multiple Choice

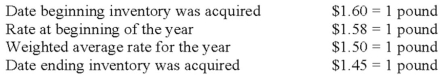

The British subsidiary of a U.S. company reported cost of goods sold of 75,000 pounds (sterling) for the current year ended December 31. The beginning inventory was 10,000 pounds, and the ending inventory was 15,000 pounds. Spot rates for various dates are as follows:  Assuming the dollar is the functional currency of the British subsidiary, the remeasured amount of cost of goods sold that should appear in the consolidated income statement is:

Assuming the dollar is the functional currency of the British subsidiary, the remeasured amount of cost of goods sold that should appear in the consolidated income statement is:

A) $108,750.

B) $112,500.

C) $114,250.

D) $125,700.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: All of the following are benefits the

Q34: On September 30, 20X8, Wilfred Company sold

Q35: If the functional currency is the local

Q36: Note: This is a Kaplan CPA Review

Q38: The balance in Newsprint Corp.'s foreign exchange

Q39: Elan, a U.S. corporation, completed the December

Q41: In cases of operations located in highly

Q42: Note: This is a Kaplan CPA Review

Q48: Dividends of a foreign subsidiary are translated

Q54: Parisian Co.is a French company located in