Multiple Choice

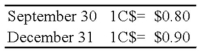

On September 30, 20X8, Wilfred Company sold inventory to Jackson Corporation, its Canadian subsidiary. The goods cost Wilfred $30,000 and were sold to Jackson for $40,000, payable in Canadian dollars. The goods are still on hand at the end of the year on December 31. The Canadian dollar (C$) is the functional currency of the Canadian subsidiary. The exchange rates follow:  Based on the preceding information, at what amount is the inventory shown on the consolidated balance sheet for the year?

Based on the preceding information, at what amount is the inventory shown on the consolidated balance sheet for the year?

A) $45,000

B) $30,000

C) $40,000

D) $35,000

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Nichols Company owns 90% of the capital

Q55: Note: This is a Kaplan CPA Review

Q56: All of the following stockholders' equity accounts

Q57: Mercury Company is a subsidiary of Neptune

Q58: On January 2, 20X8, Johnson Company acquired

Q59: On January 2, 20X8, Johnson Company acquired

Q61: Note: This is a Kaplan CPA Review

Q62: On January 2, 20X8, Johnson Company acquired

Q64: On January 1, 2008, Pace Company acquired

Q65: On January 1, 20X8, Transport Corporation acquired