Multiple Choice

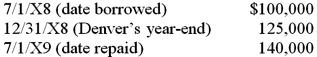

On November 1, 20X8, Denver Company borrowed 500,000 local currency units (LCU) from a foreign lender evidenced by an interest-bearing note due on November 1, 20X9, which is denominated in the currency of the lender. The U.S. dollar equivalent of the note principal was as follows:  In its income statement for 20X9, what amount should Denver include as a foreign exchange gain or loss on the note principal?

In its income statement for 20X9, what amount should Denver include as a foreign exchange gain or loss on the note principal?

A) 15,000 gain

B) 25,000 gain

C) 15,000 loss

D) 40,000 loss

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Chicago based Corporation X has a number

Q26: Note: This is a Kaplan CPA Review

Q27: Myway Company sold equipment to a Canadian

Q29: On December 1, 20X8, Secure Company bought

Q30: Company X issues variable-rate debt but wishes

Q31: The fair market value of a near-month

Q32: On December 1, 20X8, Hedge Company entered

Q33: Note: This is a Kaplan CPA Review

Q54: An investor purchases a put option with

Q62: Mint Corporation has several transactions with foreign