Multiple Choice

Note: This is a Kaplan CPA Review Question

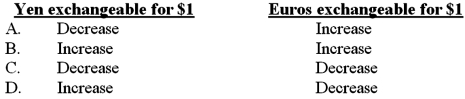

Sphinx Co. (Sphinx) records its transactions in U.S. dollars. A sale of goods resulted in a receivable denominated in Japanese yen, and a purchase of goods resulted in a payable denominated in Euros. Sphinx recorded a foreign exchange transaction gain on collection of the receivable and an exchange transaction loss on the settlement of the payable. The exchange rates are expressed as so many units of foreign currency to one dollar. Did the number of foreign currency units exchangeable for a dollar increase or decrease between the contract and settlement dates?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Company X denominated a December 1,20X9,purchase of

Q21: On December 1, 20X8, Winston Corporation acquired

Q23: Corporation X has a number of exporting

Q25: Chicago based Corporation X has a number

Q27: Myway Company sold equipment to a Canadian

Q29: On December 1, 20X8, Secure Company bought

Q30: On November 1, 20X8, Denver Company borrowed

Q31: The fair market value of a near-month

Q54: An investor purchases a put option with

Q56: All of the following are true statements