Multiple Choice

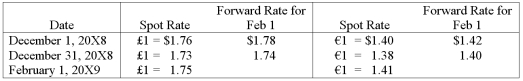

On December 1, 20X8, Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78. On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Based on the preceding information, what is the effect of the British pound speculative contract on 20X8 net income?

A) $10,000 gain

B) $6,000 gain

C) $8,000 gain

D) $2,000 loss

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Detroit based Auto Corporation, purchased ancillaries from

Q14: Taste Bits Inc. purchased chocolates from Switzerland

Q15: On December 1, 20X8, Hedge Company entered

Q16: On March 1, 20X8, Wilson Corporation sold

Q17: Suppose the direct foreign exchange rates in

Q19: Spiralling crude oil prices prompted AMAR Company

Q20: Taste Bits Inc. purchased chocolates from Switzerland

Q21: On December 1, 20X8, Winston Corporation acquired

Q23: Corporation X has a number of exporting

Q56: All of the following are true statements