Multiple Choice

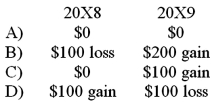

Detroit based Auto Corporation, purchased ancillaries from a Japanese firm on December 1, 20X8, for 1,000,000 Yen, when the spot rate for Yen was $.0095. On December 31, 20X8, the spot rate stood at $.0096. On January 10, 20X9 Auto paid 1,000,000 Yen acquired at a rate of $.0094. Auto's income statements should report a foreign exchange gain or loss for the years ended December 31, 20X8 and 20X9 of:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Myway Company sold equipment to a Canadian

Q9: Which of the following observations is true

Q10: Quantum Company imports goods from different countries.

Q11: Taste Bits Inc. purchased chocolates from Switzerland

Q12: Taste Bits Inc. purchased chocolates from Switzerland

Q14: Taste Bits Inc. purchased chocolates from Switzerland

Q15: On December 1, 20X8, Hedge Company entered

Q16: On March 1, 20X8, Wilson Corporation sold

Q17: Suppose the direct foreign exchange rates in

Q18: On December 1, 20X8, Hedge Company entered