Multiple Choice

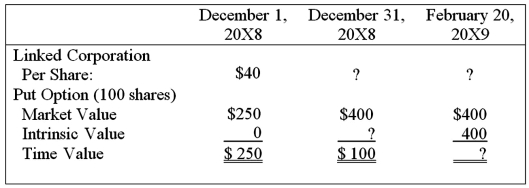

On December 1, 20X8, Winston Corporation acquired 100 shares of Linked Corporation at a cost of $40 per share. Winston classifies them as available-for-sale securities. On this same date, it decides to hedge against a possible decline in the value of the securities by purchasing, at a cost of $250, an at-the-money put option to sell the 100 shares at $40 per share. The option expires on February 20, 20X9. Selected information concerning the fair values of the investment and the options follow:  Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

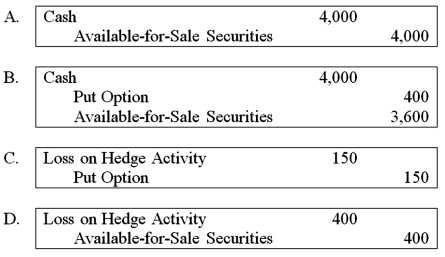

Based on the preceding information, which of the following journal entries will be made on February 20, 20X9?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Upon arrival in Chile,Karen exchanged $1,000 of

Q30: Company X issues variable-rate debt but wishes

Q33: Note: This is a Kaplan CPA Review

Q36: Heavy Company sold metal scrap to a

Q37: On December 1, 20X8, Denizen Corporation entered

Q39: Heavy Company sold metal scrap to a

Q41: Suppose the direct foreign exchange rates in

Q42: On December 1, 20X8, Merry Corporation acquired

Q47: If 1 British pound can be exchanged

Q62: Mint Corporation has several transactions with foreign