Essay

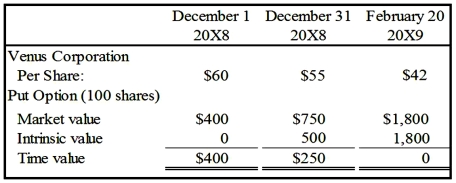

On December 1, 20X8, Merry Corporation acquired 100 shares of Venus Corporation at a cost of $60 per share. Merry classifies them as available-for-sale securities. On this same date, it decides to hedge against a possible decline in the value of the securities by purchasing, at a cost of $400, an at-the-money put option to sell the 100 shares at $60 per share. The option expires on February 20, 20X9. Selected information concerning the fair values of the investment and the options follow:

Assume that Merry exercises the put option and sells Venus shares on February 20, 20X9.

Required:

1) Prepare the entries required on December 1, 20X8, to record the purchase of the Venus stock and the put options.

2) Prepare the entries required on December 31, 20X8, to record the change in intrinsic value and time value of the options, as well as the revaluation of the available-for-sale securities.

3) Prepare the entries required on February 20, 20X8, to record the exercise of the put option and the sale of the securities at that date.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Upon arrival in Chile,Karen exchanged $1,000 of

Q37: On December 1, 20X8, Denizen Corporation entered

Q38: On December 1, 20X8, Winston Corporation acquired

Q39: Heavy Company sold metal scrap to a

Q41: Suppose the direct foreign exchange rates in

Q44: Myway Company sold equipment to a Canadian

Q45: Note: This is a Kaplan CPA Review

Q46: Chicago based Corporation X has a number

Q47: If 1 British pound can be exchanged

Q47: Spartan Company purchased interior decoration material from